How to Recoup Credit Card Processing Fees

Both methods noted below allow a retailer to pass along to the consumer one of their highest costs of doing business i.e. credit card fees.

This is not legal advice, and the regulations governing your industry, state/county/city/town/village, and credit card bureau apply. A quick google search will shed light on the rules per state.

An example is provided at www.bankrate.com

| State: California Retailers may not impose credit card surcharges but may offer discounts for payment by cash, check or other methods unrelated to credit cards.

| Recommended Method: |

State: Connecticut Any seller may not apply credit card surcharges; however, sellers may set a minimum purchase amount. Sellers may also offer discounts for payment by cash, check, or other methods unrelated to credit cards. | Recommended Method: |

State: Florida Credit card surcharges may not be added to any sales or lease transactions. There is no statute on discounts for different payment methods. | Recommended Method: |

State: New York

| Recommended Method: |

State: New Mexico

| Recommended Method: |

State: Texas Credit card surcharges may not be added to any sales transaction. There is no statute on discounts for different payment methods.

| Recommended Method: |

None of these recommendations are legal advice.

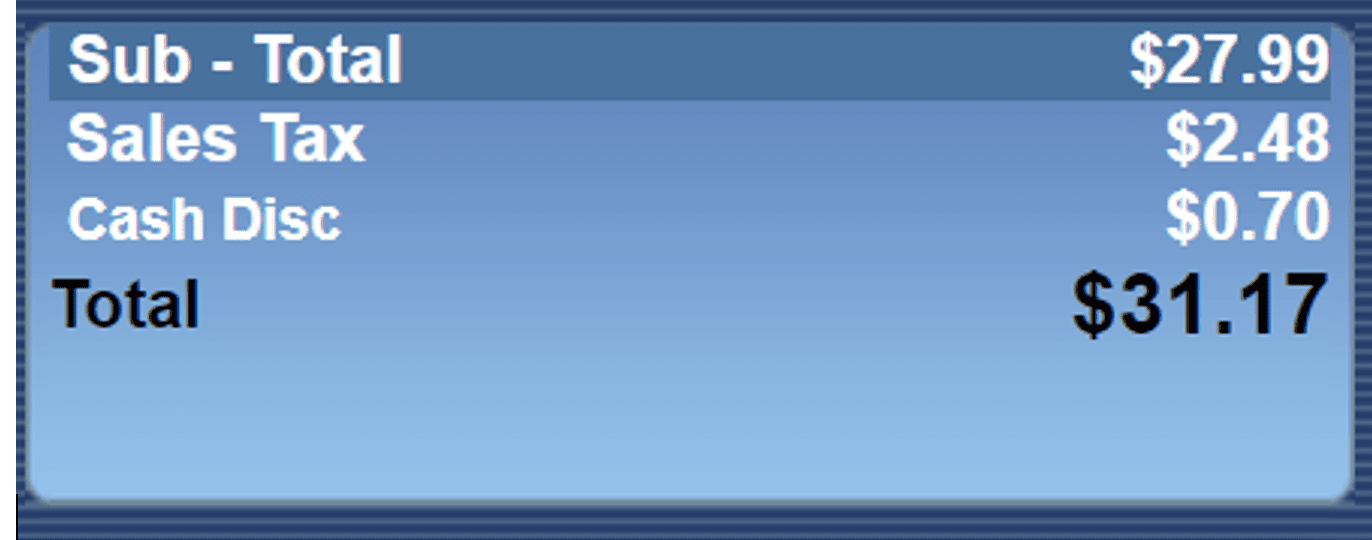

Cash Discounting

This is the method of least resistance. A Cash Discount reduces the purchase price if the customer pays with cash (or a non-credit card). As a rule of thumb, if the price on the shelf/sign/item has the standard price, this would be ideal if you elect to reduce the price at the time of sale.

This method will work best if you raise your prices on the shelf, then reduce the price by X.XX if their payment method is not a credit card. If so, then at 'End Transaction.' Then, Lightning will automatically reduce the sub-total of the sale by the percentage you indicated in the Lightning Global Setup / Convenience Fee / Cash Discounting tab.

Example:

Enable Cash Discounting – (Check this box)

Label: Cash Dis. This will appear throughout Lightning, your enhanced pole display, all receipts,

Today's Sales, Close the Day/Shift, Sales Summary, Sales Journal, etc.

Percentage: - 2.49%

During the tendering process using ‘Cash’ will instantly display the Cash Discount value the customer will be receiving. |

|

Another advantage of this method is if your business accepts pin-based debit, which shouldn't be accessed a convenience fee, (aka 'surcharge'). These customers will pay a higher price if they use their debit cards with the Cash Discount method.

This logic benefits the consumer as the price on the shelf reflects the higher price; the consumer is not misled. When they get to the register, Lightning automatically reduces the price if they are paying with a non-credit card (I.E. Cash, Check, etc.).

This does not increase or decrease the profitability of the items within the sale.

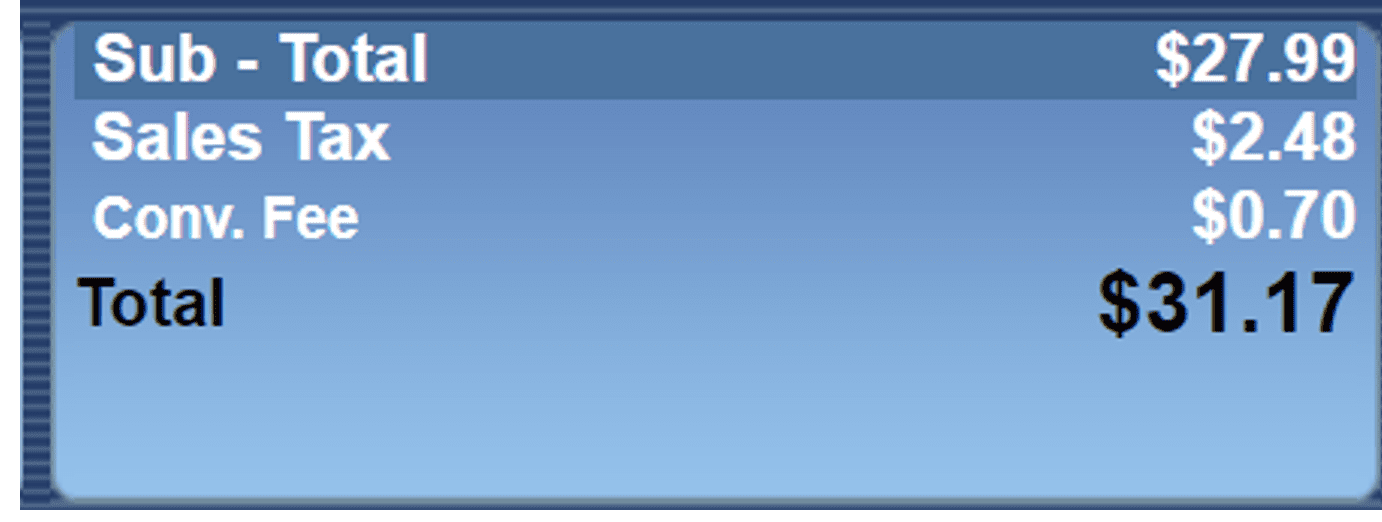

Convenience Fee

A Convenience Fee (aka 'surcharge') will increase the customer's price by X.XX% if they use a credit card. Purchases made with debit cards and cash will not be subject to the surcharge. However, there is an option to enable the convenience fee for debit transactions, which we don't recommend due to regulatory restrictions. As always, check with your trusted sources before implementing this.

Example:

Enable Convenience Fee – (Check this box)

Label: Conv. Fee This will appear throughout Lightning, your enhanced pole display, all receipts,

Today's Sales, Close the Day/Shift, Sales Summary, Sales Journal, etc.

Percentage: 2.49%

Transparency

If you wish to apply a convenience fee to credit card transactions, we suggest you insert language onto the bottom of the receipt via The Global Setup / Payments / MC-Visa / Print special message for all MC/Visa sales. Then do the same for American Express & Discover.

|

|

This does not increase or decrease the profitability of the items with the sale.